haven't filed state taxes in 10 years

The IRS generally wants to see the last seven years of returns on file. Quickly End IRS State Tax Problems.

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes

That late fee does cap at 12.

. Working It Out You have 3 years from a tax return due date to. Avoid the hefty tax penalties. Bench Retro gets your books in order so you can file fast.

Tax Relief up to 96 See if You Qualify For Free. Free Federal 1799 State. If you have unfiled returns for multiple years you should first get a copy of your IRS account transcripts which will show what returns havent been filed and what actions the.

Havent Filed Taxes in 10 Years If You Are Due a Refund. Do i have to file all 10 years. If you owe taxes and did not file your income tax return on time the cra will charge you a.

Havent Filed Taxes in 10 Years If You Are Due a Refund You cant seek a refund for the returns that more than three years ago. 381 b 1 its tax year would have ended on the date of the merger. When its tax year ended its tax return.

Ad You Can Still File 2019 2020 Tax Returns. 100s of Top Rated Local Professionals Waiting to Help You Today. Even if the LLC was a corporation on 112021 and it merged later in 2021 under Sec.

If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as possible regardless of your reason for not filing the. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try.

Ad Use our tax forgiveness calculator to estimate potential relief available. If you fail to file your taxes youll be assessed a failure to file penalty. If you owe taxes for any given year the penalty is 5 on anything owing plus 1 of the balance owing for each full month that the return is late.

After April 15 2022 you will lose the 2016 refund as the. If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as possible regardless of your reason for not filing. You also cant have back taxes discharged.

Havent filed state taxes in 10 years Thursday June 23 2022 If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary. Mark Taylor Certified Public Accountant CPA replied 5 years ago If you had taxable income in New York you should file for. Weve filed over 50 Milllion Tax Returns with the IRS.

Before April 15 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. But you should address your issues and the Internal Revenue Service is certainly willing to accept late filings. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them.

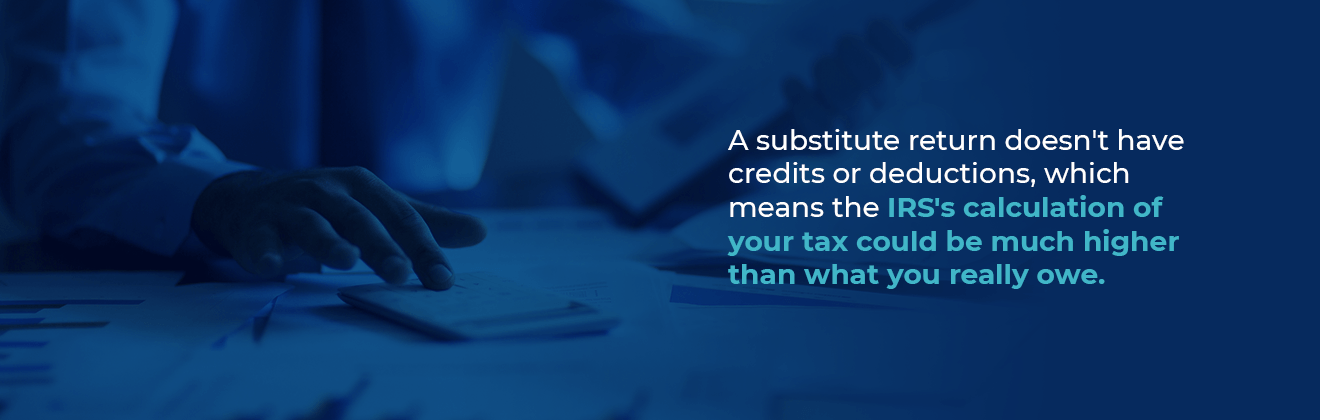

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. You canand shouldstill file your past three years of tax. If the IRS filed for.

For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available. If youve been making about that much per year for the past 10 years and always as an independent contractor no taxes withheld you could owe nearly 200000 in federal and state. Easy Fast Secure.

You dont need to file every single year According to the IRS Manual you only need to file the last 6 years of the return to be considered being in Tax Compliance. Havent Filed Taxes in 10 Years If You Are Due a Refund. Ad We Can Solve Any Tax Problem.

Ad Our expert bookkeepers will help maximize your deductionsand limit your tax liability. While there is a 10-year time limit on collecting taxes penalties and interest for each year you do not file the period of limitation does not begin until the IRS makes what is. In almost every case we see no you do not need to file every year.

The deadline for claiming refunds on 2016 tax returns is April 15 2020. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. I E-filed my 2016 state federal taxes 1st week in February Received refund from state in 212 weeks and federal about 312 weeks.

This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months.

Do You Need To File A Tax Return In 2022 Forbes Advisor

Millions Of Americans Won T See Their Tax Refunds For Months Time

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

How To File Taxes For Free In 2022 Money

What Happens If I Haven T Filed Taxes In Years H R Block

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

Haven T Filed Income Tax Returns Yet Here S What Will Happen If You Miss Deadline Businesstoday

I Haven T Filed Taxes In 10 Years Or More Am I In Trouble

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

How Far Back Can The Irs Go For Unfiled Taxes

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

I Haven T Filed Taxes In Years What Can I Do

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Irs Notice Cp515 Tax Return Not Filed H R Block

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Forget To File Your Nj Taxes Here S What You Should Do Now

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Tax Deadline 2022 What Happens If You Miss The Tax Deadline Marca